You are not the only one scratching your head at why domestic flights in Canada feel bogged down by fees. Government-imposed or third-party fees* are higher in Canada than in other countries and represent the most significant barrier to competitive growth and affordable air travel.

As these fees continue to rise—outpacing inflation—aspirations of accessible air travel remain unattainable for millions of Canadians.

The cost of travel: A breakdown of government-imposed fees

Canadian travellers are required to pay five distinct government fees in Canada, leaving guests with no choice but to pay a minimum of 75 dollars on every flight before airlines even add the fare. Not only does this strain traveller’s budgets, while they already are facing an affordability crisis, but it stifles low-cost competition within the industry.

Have you ever noticed that you don't have to swipe your credit card to pay Canadian Border Service fees at land crossings, but you do when you pay for your plane ticket?

In stark contrast, Australia and the United States third-party fees are less than half the price of Canada and seemingly unbelievable low fares. It also explains why we don’t see many low-cost American-based airlines flying in Canada – entering our market is simply too expensive.

A closer look at fees

Here’s a comparison of the average government-imposed fees charged on domestic flights in Canada, Australia and the U.S.:

| Fee |

Canada (CAD) |

Australia (AUD) |

USA (USD) |

| Airport improvement fee |

$38 | $18.16 | $4.50 |

| Air traveller security charge |

$11 | $2.87 | $5.6043 |

| Air traffic control and federal taxes |

$11 | $0.00 | 7.5% of ticket + $5 |

| Airport landing fees | $13 | $5.65 | $5-10 |

| Aviation fuel tax |

$0.04/liter | $0.0356/liter | $0.043/gallon |

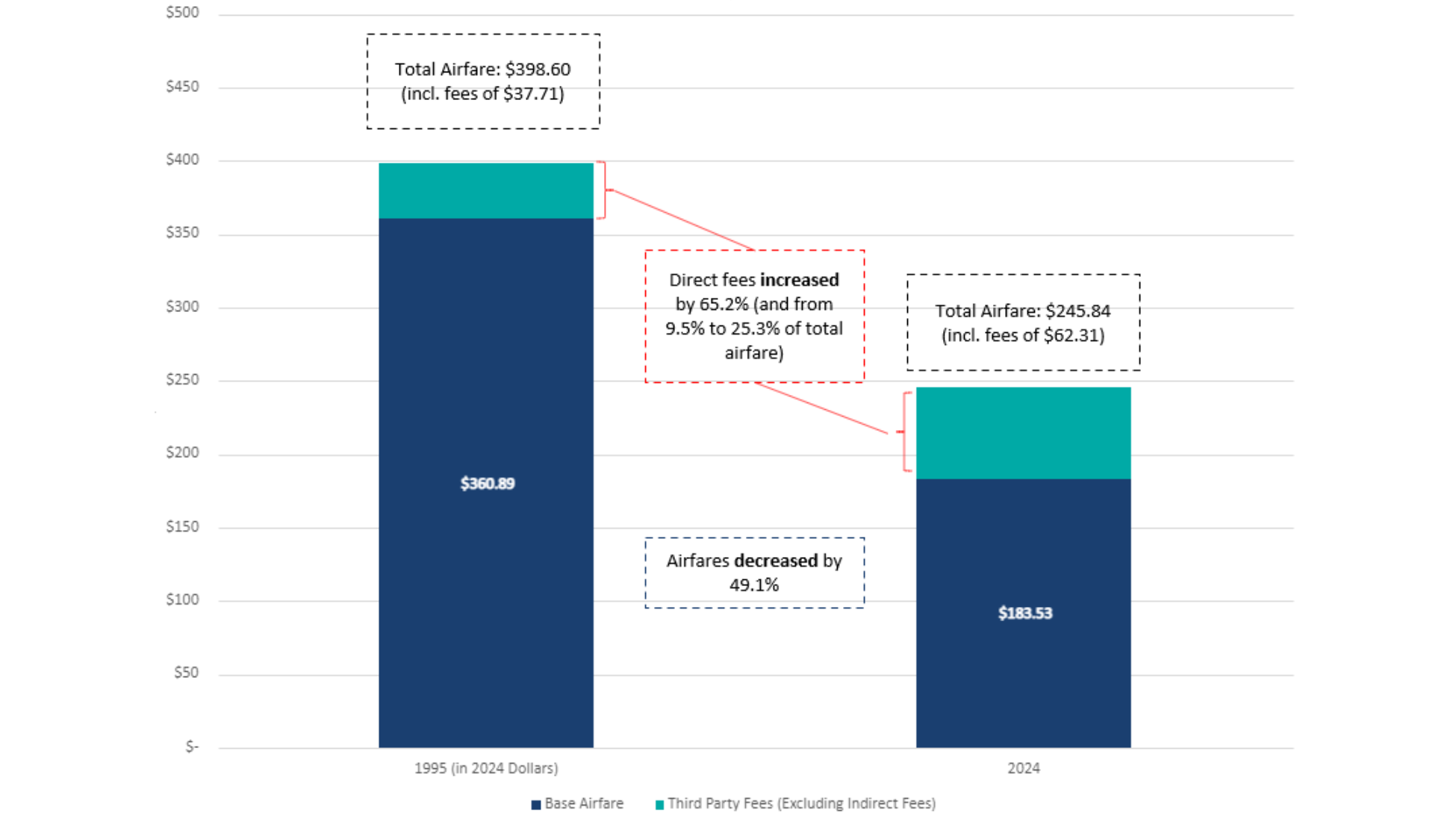

Despite these costs, Canadian air fares have dropped significantly in the past three decades (partially due to WestJet’s long-standing low-cost mission) while a significantly greater percentage is made up of fees. The following graph indicates that while airfares have decreased by almost 50 per cent since 1995, government-imposed fees have increased by more than 65 per cent.

Average domestic airfares and direct third-party fees from 1995-2024

Between 1995 and 2024, direct third-party fees increased by 65.2 per cent (and from 9.5 per cent to 25.3 per cent of total airfare). Airfares decreased by 49.1 per cent.

The need for change

Current government-imposed fees prevent millions of Canadians from being able to afford domestic air travel despite the essential nature of this service. Reducing these fees by just 50 per cent could unlock greater access to air travel, stimulating demand for an additional 12 million one-way domestic flights each year. This boost in demand would be enough to support and sustain another Canadian airline comparable to the size of WestJet.

With the right adjustments, the skies could become more affordable for millions, fostering greater connectivity and economic opportunity across the country.

*Third-party fees are comprised of direct and indirect fees that are passed on to guests from airport partners and federal regulators. Direct fees imposed on passengers include airport improvement fees (AIFs) and air travellers security charges (ATSC). Fees imposed on airlines that are passed through to travellers include NAV Canada/air traffic control fees, aviation fuel taxes and federal government ground rents, which are passed through in higher airport landing fees and terminal charges.